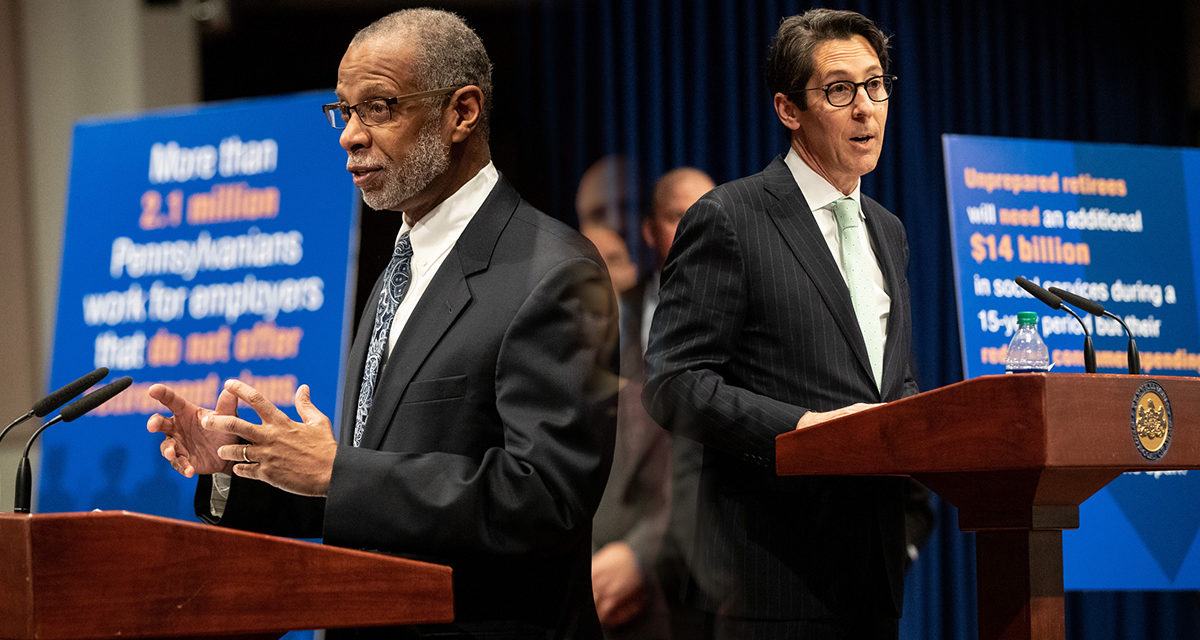

By State Treasurer Joe Torsella and Senator Art Haywood

Waiting tables. Cleaning restrooms. Bagging groceries.

These are jobs that need to be done, and plenty of Pennsylvanians put in an honest day’s work doing things just like this. But most of us want something else for ourselves when we reach the end of our working lives. We want to be able to retire with dignity, and enjoy at least a few years catching up on the moments and people we missed while working for the majority of our lives.

Unfortunately, a safe and secure retirement is an uphill climb for most Americans, despite our nation’s economic recovery. One in three Americans doesn’t have a single dollar saved for their retirement, and 2.1 million Pennsylvanians don’t have a workplace retirement plan to contribute to.

The outlook is even worse for communities of color, with two-thirds of Latino households and 62 percent of African American households having nothing saved for retirement, compared to only 37 percent of white households without savings.

But it doesn’t have to be this way.

As elected officials, we have an obligation to serve the people of our state, and we know we can’t wait on Washington to solve our problems. We know that we’re facing a crisis in retirement security, with an aging population where many lack the savings to ever stop working.

Luckily, there is already a powerful new tool to help. It’s called an auto-IRA, which would begin to cover those 2.1 million Pennsylvanians without a plan, and would make it as easy as possible for employees to get started saving for their retirement years. Individuals without access to retirement savings through an employer will be automatically enrolled, with the ability to opt-out at any time. The accounts are portable—meaning if you move from job to job, your account moves with you.

The program will operate in a similar way to the PA 529 College and Career Savings Program, which has helped hundreds of thousands of families save for postsecondary education expenses over the past 26 years.

Some may say this idea goes too far, and that workers without a retirement plan through their job should just learn all the complexities of the financial products market and start a plan on their own. Others may say the idea doesn’t go far enough, and that what we need to do is dramatically expand Social Security to pay far more to individuals who are ready to retire.

Molly Schenker, a social worker with no current retirement savings plan, said that as a millennial professional, “I fear my future will never include what my parents had before me—a home, a child and health insurance. If I were given the opportunity to start a retirement plan, I’d at least have an idea of what kind of goals I should be setting for myself.”

The truth is that this is something we can actually achieve—now. And it would begin helping our workers now.

Pennsylvanians without a retirement plan through their job are already overburdened, and don’t need more barriers in between them and a convenient, simple retirement plan. Those 2.1 million Pennsylvanians are also free to set up accounts of their own whenever they like, or opt out of the auto-IRA plan entirely.

We don’t have to wait on our federal government to suddenly figure out how to work together, or to make changes of any kind to Social Security.

This is the type of idea—based on commonsense and finding common ground—that we still know how to do here in Pennsylvania. An auto-IRA program is something we can and should achieve on our own, and that would benefit millions of Pennsylvanians—both retirees and taxpayers—now and into the future.